Contents

Working as a Contractor

Working as a contractor is increasingly being taken up by many Australians with the rise of the gig economy. From an employer’s perspective, there are many factors that legally distinguish your employees from your contractors.

An independent contractor is someone who performs work for a company under their own ABN.

Contractors often can either operate their business and have many clients, or do work for one company at a time.

If you’re a contractor, it can be difficult to navigate your responsibilities, particularly when it comes to complex areas like superannuation, tax, insurance and putting together an invoice.

But don’t stress! Below, we’ve outlined everything you need to know if you’re working as a contractor.

Your Responsibilities as a Contractor

Contractors have many different responsibilities pertaining to superannuation, tax and insurance.

Superannuation

As contractors aren’t entitled to superannuation from the company they are performing work for, you could consider making voluntary personal contributions to your chosen super fund.

Taxation

The sharing economy is subject to many different taxes such as goods and services tax (GST), income tax or any other tax that applies to earnings. The sharing economy is where people purchase assets or services for a fee through a digital platform like a mobile app, or website.

When considering your income tax options as a contractor, you may be eligible to enter a voluntary agreement with the hirer company that allows them to withhold tax for you.

You should also be careful about rules around Personal services income (PSI). PSI rules could impact the deductions you can claim.

Insurance

Contractors are not entitled to paid sick leave. Similarly, they’re not entitled to worker’s compensation in the event of a work-related incident.

For these reasons, contractors should consider income protection insurance, liability insurance and asset and revenue insurance.

You can read about these different types of business insurances here.

Creating Invoices: What to include

As a contractor, it is a good idea to have a proper invoicing system. It helps you protect your business’ cash flow, maintain good records and ensure you’re on track to meet your tax obligations.

An invoice shows the record of purchase for your customers and gives details of the purchase, the specific type of service or product and the agreed upon price.

If your business is not registered for Goods & Services Tax (GST), your invoice is called a ‘regular invoice’ and will not include a tax component.

If you make a taxable sale of more than $82.50, then you’re required to provide your GST registered customers with a tax invoice.

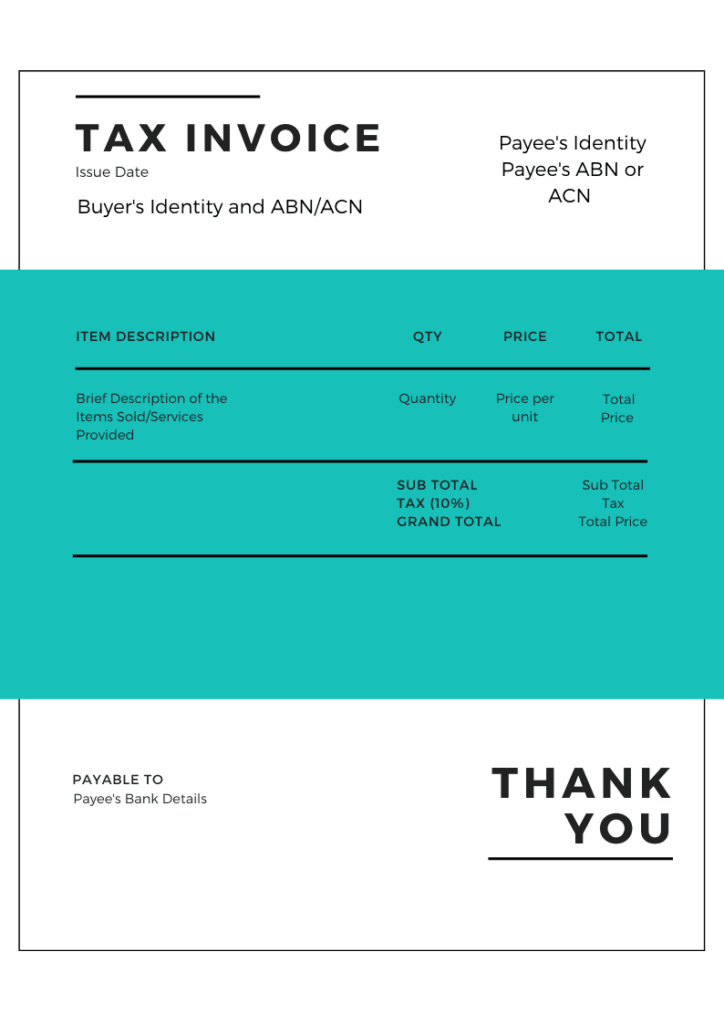

Tax invoices must be labelled ‘tax invoice’ and must include the GST amount for each item.

Tax invoices must include seven compulsory elements to be valid. It must clearly determine:

- That the document is intended to be a tax invoice

- The seller’s identity

- The seller’s ABN or ACN

- The date the invoice was issued

- A brief description of items sold (including the quantity and price)

- The GST amount (if any) payable (you can learn how to calculate GST here)

- The extent to which item sold includes GST. To do this you can either show the GST amount for each item or clearly state that the total price includes GST

These tax invoices will need to include the buyer’s identity or ABN if the taxable sale amount exceeds $1000. You can find more specific information on invoicing here.

Whilst these are the basic requirements for creating a tax invoice, you can find detailed tips here to make your invoices more unique and suited to your business.

Different Types of Invoices

As a contractor, there are many different types of invoices you can send to your customers.

Here’s a breakdown of the most common types of invoices:

Pro forma invoice

This can be thought of as a pre-invoice, which is sent before completing work for a customer. It details to your customer how much to pay once you perform your service or deliver your goods. Whilst it does present a commitment to provide something, the terms in a pro forma invoice can change.

Interim invoice

This breaks down the value of a large project into multiple payments. This invoice can be sent in intervals as you complete a large project. It is very helpful in managing your small business’ cash flow as you can charge customers on an ongoing basis for materials, labour and other operating costs.

Final invoice

This is sent after you complete a project, and unlike a pro forma invoice, is a demand for payment. This generally includes an itemised list of goods and services you provided. Sending a final invoice as soon as a project is completed is helpful in keeping cash flows into your business at a healthy rate.

Past due invoice

When your customers do not send you payment by the due date on the final invoice, a past due invoice may be sent. This acts as a reminder and may also include any late fees or interest incurred as a penalty for the delayed payment.

Recurring invoice

This is used to bill customers for recurring, on-going work. Similar to a utility bill, these invoices allow you to charge the same amount regularly on an agreed-upon billing interval.

Credit memo

This can be used to acknowledge any dues you owe to your customer. It is generally equal to or less than the amount originally paid by the customer, and it is often used for returns, faulty goods or mistakes in shopping.

Talk to a Lawyer

Having a contractor agreement is an extremely important document to secure your revenue streams and dictate payment terms. Whether you are a business engaging a contractor, or an independent contractor providing services to a client, we can help!

If you have any questions, or think you might need a Contractor Agreement or a Service Agreement, you can reach us on 1800 730 617 or email team@sprintlaw.com.au.

Get in touch now!

We'll get back to you within 1 business day.

0 Comments on "Working As A Contractor"