Starting a business is a big financial commitment. There are a lot of expenses when you’re starting out, and most businesses need some extra financing to get off the ground and scale with growth.

There are two main ways to finance a new business – debt and equity.

- Debt financing means borrowing money i.e. taking out a loan.

- Equity financing means giving an investor a share of your company.

Debt financing

Taking out a loan is a common way to finance a new business venture. There are two main sources of loans for new businesses:

- Banks

- Private loans (often from friends or family)

Loans can either be secured or unsecured. A secured loan means that if the borrower fails to repay the loan, the lender can take ownership of a valuable asset, such as a house – in other words, the house is taken as ‘security’ for the loan. If you have a secured loan, you will usually be asked to sign a separate ‘security’ agreement. The secured property will also usually be registered on the Personal Property Securities Register (PPSR). An unsecured loan means that there is no security for the loan.

If you get a loan from a bank, the bank will normally provide you with all the legal documentation. If you’re unsure about what you’re getting yourself into, don’t just sign – you should get a lawyer to review the documents the bank gives you. If you get a private loan it’s really important to make sure you have a Loan Agreement in place. A Loan Agreement will set out the essential details such as: how much the loan is for, the purpose of the loan, the repayment term and if there is interest.

Equity financing

Equity financing is where someone invests money in a company in return for shares.

There are many types of equity financing – the most common sources for startups and small businesses include:

- Friends and family

- Angel investors

- Venture capital

- Accelerators/ incubators.

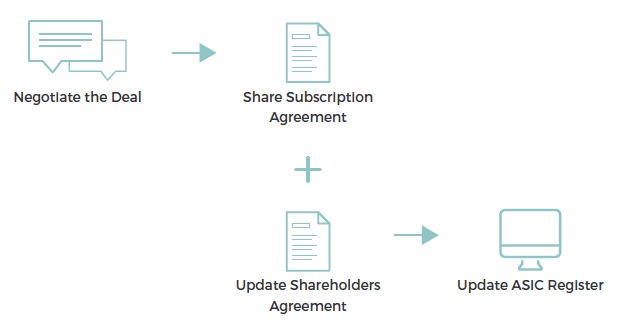

Completing an equity finance deal is a complex legal process. The key steps are as follows:

- Negotiate the deal – Before everything gets completely finalised, it’s often a good idea to agree on the key terms of the investment in a Term Sheet. A lawyer can help you draft this up so you’re clear about the main points of agreement before moving ahead.

- Share Subscription Agreement – This is a legally binding agreement that the investor will make payment of funds in return for a determined amount of shares at a certain valuation. There are sometimes extra conditions, such as:

- Preference shares – these are shares with additional rights attached e.g. preference shareholders often get favourable anti-dilution and rights on liquidation.

- Share vesting – this is a mechanism used to incentivise shareholders – usually founders of a startup – to stay with the company. The basic idea is that the founders don’t get their shares until they’ve completed certain milestones and time periods.

- Shareholders Agreement – This is the document that governs the relationship between the founders and the investors. The basic structure is similar to the one described in Chapter 3 among co-founders, with a few extra clauses that deal with equity investors.

ASIC updates – The company’s ASIC register needs to be updated to reflect the new shareholdings and directorships.

We’ve created the below simple flow chart so you can see how the equity financing process plays out in practice.

Other types of finance

There are many other ways of financing, such as ‘convertible notes’ which is a mixture of debt and equity. Also, finance is constantly evolving and adapting to changes in the market, and new ways of financing is emerging all the time. For example startups these days use SAFE Notes – a simple alternative to a convertible note first developed by Y-Combinator – to get quick investment. Crowdfunding is another way that many companies are getting access to finance.

In conclusion…

In this chapter we’ve learned about the various ways of getting finance. Whatever method you choose will depend on your financial situation and your business structure. Either way, you really want to make sure you have your legal documents in order so you know what your obligations are and to make sure you are getting a good deal.

Interested in working with us?

Tell us about your legal issue and we’ll put together a fixed fee quote for you.

Previous

Previous